Why the sales price of IT companies keeps rising

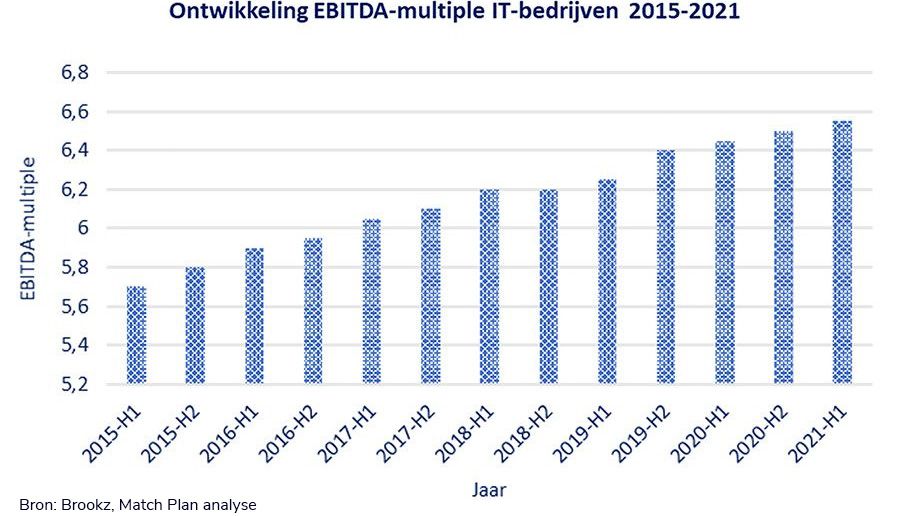

The price of IT companies continues to rise. According to research from Brookz, buyers today pay an EBITDA multiple of 6.55 for an average IT company. A few years ago this multiple was only 5.7. Acquisition advisor Lucas Troelstra of M&A agency Match Plan explains why prices keep increasing.

For six years in a row there has been an increase in the average EBITDA multiple (factor times the operating profit before interest costs, taxes and depreciation) paid for IT companies in the Netherlands.

An important reason behind the sharp increase is the general digitization of society. Global digitization has gained momentum in recent years. Learning, working, shopping: switching between the physical and digital domain is taking place in record time.

The corona pandemic has accelerated digitization even further. Due to the strong increase in working from home, the need for hardware and cloud solutions, among other things, has reached a rapid acceleration. Due to the temporary closures of physical stores and the catering industry, many entrepreneurs in these sectors have also switched to online concepts and solutions, which in turn has generated a lot of work for website and app developers, but also for hosting and IT consultants, for example.

The entire digitization process must be secure and reliable, which in turn offers work for cyber security experts. This digitization also raises security issues.

As a result of these trends, the IT sector is an interesting market for both strategic parties and investors, which increases the demand and therefore the price of this kind of company. This positive feeling in the IT sector certainly does not apply to all sectors in the Netherlands, for example the hospitality industry and the travel and events sector are sectors that are struggling with falling EBITDA multiples.

Another reason for the increased average EBITDA multiple is the fact that market conditions are very favorable. There is a lot of capital available and interest rates are historically low, which makes for an ideal investment climate. As a result, both investors and strategic parties are looking for new investment opportunities more than ever.

Because the IT sector has more than proven its resilience during the corona crisis and has good prospects for the future (the digitization drive will continue in the coming years), the sector is at the top of the M&A list for many parties.

For entrepreneurs, the current market developments make it an excellent time to consider a transfer. However, during such a process, make sure that you do not only focus on the EBITDA multiple. Indeed, there are significant differences in the valuation of companies within the sector, which depend on a wide range of both internal and external factors.

How much a company is sold for also strongly depends on the quality and professionalism of the sales process.

Source: https://www.consultancy.nl/nieuws/38744/waarom-de-verkoopprijs-van-it-bedrijven-maar-blijft-stijgen

Nederlands

Nederlands